Truro & Colchester Partnership for Economic Prosperity Hires New CEO

TRURO, NOVA SCOTA — The Board of the Truro & Colchester Partnership for Economic Prosperity is pleased to announce it has recruited its new CEO. Brennan Gillis, a resident of Valley, will join the organization on Jan. 8, to begin ramping up the work of the newly formed Partnership.

The hire is a result of eight months of volunteer planning and collaborative talks with businesses, communities and government partners to secure funding for the new Partnership. Gillis will co-locate with ACOA, NSBI and CBDC NOBL at 35 Commercial Street, Suite 208, Truro.

Gillis has worked previously with the Community Business Development Corporations, RRFB Nova Scotia (now Divert Nova Scotia) and Mitacs Inc., a national not-for-profit organization that funds innovative research collaborations between business and academia. Brennan obtained his Masters of Business Administration from Saint Mary’s University and has been an active volunteer in the community working with young professionals and business start-ups. He is passionate about the opportunities in the region.

“I’m really excited to work with the Partnership,” said Gillis. “I love living in this community. Working with a committed group of partners who want to grow the region and increase business opportunity – it’s a dream job.”

The Truro and Colchester Partnership for Economic Prosperity is a newly established Regional Enterprise Network (REN) financially supported by the towns of Truro and Stewiacke, the County of Colchester, Millbrook First Nation, the business community through the Truro & Colchester Chamber of Commerce and the Province of Nova Scotia. Partners have agreed to initially finance the organization for three years to encourage and stimulate economic growth.

In preparation for the strategic planning process which Gillis will spearhead in early 2018, the organization has contracted Turner Drake & Partners to complete an Economic Market Assessment.

“We are excited to have all the critical parts coming together now for our Partnership for Economic Prosperity,” said Mark Wood, Chairman of the Truro-Colchester Partnership and President/CEO of Ocean Sonics. “With Brennan starting in the New Year we hope to bring the business community together, grow our region and make it the place where people choose to live.”

A great community welcome to Anne MacDonnell

Chamber President Alex Stevenson & Mayor Wendy Robinson introduced the new CAO of Stewiacke, Anne MacDonnell at the Stewiacke Legion, Dec 4th.

Breakfast with MP Lisa Raitt

Join us for breakfast with The Hon. Lisa Raitt, PC, MP, Deputy Leader of the Opposition, Member of Parliament for Milton, Friday, October 27, 8:00 a.m., Holiday Inn Truro. RSVP required by calling 902-895-6328 or email oa@tcchamber.ca

Outstanding local businesses to be honoured with 2017 Small Business Awards

TRURO - The Truro & Colchester Chamber of Commerce has announced this year’s Small Business Week award recipients.

“The quality of the applications was excellent,” said Chamber President Alex Stevenson. The people operating these businesses are amazing and all are truly deserving of recognition.

“However, there can only be one winner in each category and the decisions were difficult. I thank our vetting committee for their hard work, and I thank everyone who took the time to submit nominations.”

The award recipients of 2017 are: New Small Business of the Year, Yoka Sushi; Small Business Achievement, S. Sorenson Electric Ltd.; Small Business Innovation, Tobias Portraiture; Export Achievement, My HOME Apparel ; Excellence in Community Development, The Nook & Cranny; Small Business Growth, Berry’s Furniture ; and Agriculture/Agri-Small Business, Truro Agromart Ltd. The seven awards are sponsored by Community Credit Union, PWC, RBC, Nova Scotia Business Inc., Town of Truro, BDC and MNP LLP, respectively.

Recipients will be honoured at this year’s Small Business Week Award Luncheon, Oct. 18, 12 p.m., at the Best Western Glengarry and Conference Centre. All nominees will receive recognition for their contributions to the local economy during the luncheon. Guest speaker will be Heather Coulombe, of the Farmer’s Daughter Country Market, Whycocomagh, NS. The business offered free land in return for employment at their store last year and received 200,000 emails in reply.

To reserve seats at the luncheon, contact the Chamber of Commerce office by calling 902-895-6328 or email [email protected]. Seats cost $25 for chamber members and $35 for future members (plus tax).

The Chamber will kick off a week of Small Business Week activities with a Women in Business Breakfast on Monday, Oct. 16 at the Holiday Inn from 8:30 to 10 a.m. with guest speakers Miriah Kearney, Founder and CEO, My Home Apparel and Stephanie Jones, Owner, McDonald’s Restaurants. This event is offered to all business women in the community at no cost. Registration is required.

On Oct. 17 Patterson Law’s Truro Business law practice group will present Building Business Success in partnership with the Truro & Colchester Chamber of Commerce. This event will bring together key business leaders to both celebrate this area’s economic success and provide business owners at all stages with tools to build a foundation for sustainable growth.

Using a panel presentation format led by professionals and other business owners, each session provides practical advice for concrete examples identifying best strategies for success for any entrepreneur. This event will be held from 11 a.m. to 2 p.m. at the Marigold Cultural Centre. There is no charge for this event and a complimentary lunch and refreshments will be provided.

RSVP by emailing [email protected]

The panel discussion themes are navigating successful business transition from generation to generation, leveraging technology for success, smart growth, impact of proposed tax changes on small business, attracting top talent and protecting your business assets.

On Oct. 19 a member’s networking night will be held from 5 to 7 p.m. at the Marigold Cultural Centre.

The last event of Small Business Week on Friday will be Live & Work. This event will allow businesses to participate in an initiative to build the vibrancy of our region and reach out to our future workforce. The purpose is to bring attention to our community offerings and build a competitive awareness to assist youth in securing employment and developing an attractive lifestyle here. We welcome businesses of all kinds, big and small, to join us in showcasing the local opportunities.

To participate, businesses are asked to register with the Chamber as a Live and Work location willing to open their doors to visitors on the event day. We ask that someone be available to greet visitors at their location between 12:30 and 3:30 p.m., as well as to answer questions about the job opportunities in their field of work.

Watch the chamber website and Facebook page for a schedule of chamber-hosted events and details on other Small Business Week events in the area.

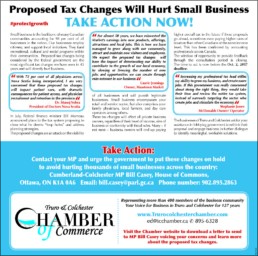

Proposed tax changes will hurt small business

Here is what some local business people are saying about the impact the proposed changes could have on their operations:

“With 75 percent of all physicians across Nova Scotia being incorporated, I am very concerned that these proposed tax changes will impact patient care, with dramatic consequences for patient access, and physician recruitment and retention in the province.” – Dr. Manoj Vohra, President of Doctors Nova Scotia

“For almost 50 years, we have reinvested the Market’s earnings into new products, offerings, attractions and local jobs. This is how we have managed to grow along with our community, attract and maintain new visitors and employees. We expect the proposed tax changes will have the impact of deteriorating our ability to contribute to the growth of our local economy, by slowing or freezing the number of new jobs and opportunities we can create through reinvestment in our business.” – Laurie Jennings, Owner, Masstown Market

“Increasing my professional tax load stifles my ability to grow my business, and create more jobs. If this government was really concerned about doing the right thing, they would take their time and review the entire tax system, instead of narrowly targeting the sector who create jobs and stimulate the economy.” – Stephanie Jones - McDonalds Owner/ Operator

Take Action Now!

Small business is the backbone of many Canadian communities accounting for 98 per cent of all businesses in the nation. Our businesses employ citizens; and our businesses support local initiatives, everything from sports teams to fundraising drives. They fund recreational, cultural and social programs within their communities. Proposed tax changes being considered by the federal government are the most significant tax changes we have seen in 45 years and will directly hurt business.

In July, Federal finance minister Bill Morneau announced plans to the tax system proposing to close what he deems “loop holes” and address planning strategies.

The proposed changes are an attack on the viability of all businesses and will punish legitimate businesses. Small business encompasses your retail and service sector, but also comprises your family physicians, local farmers, and day care operators among others. Restrictions proposed on income

sprinkling to family members, passive investments and converting income into capital gains will adversely affect the profitability of small business.

These tax changes will affect all private business owners, regardless of their level of income, size of business or conformity with fiscal rules. Many – if not most – business owners will end up paying higher overall tax in the future if these proposals go ahead, sometimes even paying higher rates of taxation than other Canadians at the same income level. This has been confirmed by accounting professionals across Canada.

Efforts to have meaningful dialogue with government on the dire effects of the proposed changes have been unsympathetic.

The window of opportunity to provide feedback through the consultation period is closing. The time to act is now before the Oct. 2, 2017 deadline.

The businesses of Truro and Colchester ask for your assistance in lobbying government to rethink their proposal and engage business in further dialogue to identify meaningful, workable solutions.

Take Action:

Contact your MP and urge the government to put these changes on hold to avoid hurting thousands of small businesses across the country and to have a broader, thoughtful discussion regarding the measures needed to stop those who use their businesses to avoid paying taxes.

Cumberland-Colchester MP Bill Casey, House of Commons Ottawa, ON K1A 0A6 or Truro Office 40 Inglis Place Truro, NS B2N 4B4

Email- [email protected]

Phone number - 902.895.2863

Visit the Chamber website to: 1. Download a form letter to sign and send to MP Bill Casey;

CLICK HERE to download a letter to MP Bill Casey

2. access a link to a national petition, - Click here

3. Learn how these changes could impact your business;Click Here

4. Access a porthole to share your story with the Chamber network. Click Here

Representing more than 400 members of the business community

Your Voice for Business in Truro and Colchester for 127 years

www.Trurocolchesterchamber.com

895-6328 [email protected]

Federal Government Needs to Extend the Tax Consultation Deadline -op-ed

Businesses across Canada are voicing well-founded concerns about the federal government’s proposed tax changes for privately-held corporations. The proposed legislation is one of the most significant changes to tax regulation in 50 years and the government has provided a mere 75 days (during summer) to provide feedback. The business community needs more time to assess these complex changes to fully understand the wide-spread impact this will have on small- to medium-sized businesses. We need Minister Morneau to extend the deadline beyond October 2nd, 2017 to allow for proper consultation.

If implemented, these changes will drastically degrade the financial stability of all small businesses and not just a group of ‘highly paid individuals who are reluctant to pay their fair share of taxes.’ It will impact all incorporated private business, such as: start-ups, corners stores, farmers, or individuals who offer services like lawyers, accountants and other consultants.

In fairness, no one likes to pay more taxes, but we know the government also needs to reform the current tax legislation to address situations where individuals do not pay their fair share. However, the proposed tax changes on income splitting, holding passive income in a private corporation, and converting regular income into capital gains will apply to all privately-held corporations and not just the minority of high-income individuals.

Why should we care if small businesses can split income among family members, accumulate tax-advantaged savings, or maximize the sale price of their business through capital gains to fund their retirement? Because these changes may stop people from opening new businesses, or existing businesses from re-investing and expanding, or it could cause the prices of everyday products and services to go up as businesses absorb tax increases—all at a time when we need more business, more expansion, more jobs and competitive pricing in Atlantic Canada.

We need legislation to support small business in our region, not hinder it. Most incorporated private businesses are owned by friends and neighbours who are at the core of our communities. In fact, according to Statistics Canada (July 2017), 85-90 per cent of businesses across Canada are small-to-medium in size (80 per cent of which have less than 20 employees). These businesses create jobs locally and to drastically change the financial attractiveness of operating a business by adding unnecessary risk will slow economic development in Atlantic Canada.

You see, unlike an ‘employee’ who may have access to a company-sponsored health plan, retirement plan, sick leave, maternity leave, or other benefits; a small business owner must pay for these benefits. They often will put personal assets at risk to fund their business, and family members often help operate the business. Speak with anyone who has ever started a small business and they will tell you it takes several years to get it up off the ground or to even make a profit before they recoup their start-up costs.

At the heart of these tax changes, is a proposal to impose ‘reasonableness tests’ that will dictate how much a family member who assists with business operations can be paid (known as income splitting). This provision is very vague and open to interpretation. We believe more understanding and rigor to reduce ambiguity is a ‘reasonable expectation’ for business planning and stability.

Small businesses must plan and provide for financial outlays, so it is similarly unfair to significantly increase the taxes applied to savings held within a corporation (known as passive investment) across the board. These savings are retained for a variety of reasons like paying benefits or salaries to employees during periods when business slows or is not profitable, or for future business investments—and these retained earnings are eventually taxed as personal income if the funds are withdrawn from the company.

Lastly, people should have a reasonable expectation they can sell their business and provide for their retirement (like an employee can do). In 2017, a shareholder (who may be a family member or someone who holds shares through a family trust) of a qualified business is exempt from taxation up to just over $835,000 from the sale of the shares of the business. The government is now proposing new restrictions for claiming this exemption. Also, they are proposing that if a shareholder sells shares of the family business after July 18, 2017 to a family member’s corporation, the gain may be taxed as a dividend rather than as a capital gain. Further, if the shares were originally acquired from another family member, there could be double taxation—this could adversely impact the transfer of businesses from one generation to the next.

Atlantic Canadians can not risk additional economic uncertainty such wide-sweeping tax changes could create. The consequences could mean business creation is stalled, business owners will increase prices, or jobs are reduced or not created. We need economic policy and taxation solutions to work for Atlantic Canadians, that support business and create jobs, and we need to be properly consulted on any tax changes. Visit the Atlantic Chamber of Commerce’s website (extendthetaxdeadline.ca) to learn more, share your business impact story, and to send a letter to your MP with a clear message for the Finance Minister to extend the consultation deadline on the Taxation of Private Corporations beyond October 2nd, 2017.

Sheri Somerville

CEO

Atlantic Chamber of Commerce

Fall Flavours Festival showcases local talent

Fall Flavours Festival showcases local talent

A huge thank you to all of the local chefs showcasing their talents at the Chamber’s third annual Fall Festival of Flavours. Gifts from our sponsor Sara Bonnyman Pottery were presented to the top chef in each category by Chamber president Alex Stevenson.

The top chefs were determined by taster’s votes during the evening as the dishes were samples.

Every dish was a delight for the taste buds and all chefs are thanked for their time and participation in this event that show cases some of the best chef talent food in Colchester.

The winners of the evening are: Taco Stiles, Mari Ann Stiles – Top Appetizer; Frank and Gino’s, Executive chef James White and sous chef Chad Neil - Top Main; and Great British Grub, Jane Elgee- Top Dessert.

The top overall chef award sponsored by Acadian Trophies, named by receiving the greatest total number of votes by tasters, was awarded to Mari Ann Stiles, Taco Stiles.

This event was generously supported by our sponsors Sara Bonnyman Pottery, Green Diamond, Acadia Trophies, Community Credit Union, Truro Nissan, Select Nova Scotia, Town of Truro, Burchell MacDougall and Investors Group.

Thank you all for joining us to support you Chamber that works to provide advocacy and support to the business community.

Fall Flavours Festival to feature Best Chef competition

Fall Flavours is next Thursday night ! If you haven't booked your tickets yet and are wondering what some of the awesome dishes are that will be served, here's a sneak peek:

** Pan seared Atlantic salmon, Moroccan style pearl couscous, carrot butter sauce topped with spiced fruit salsa

** Vegetarian Squash Soup topped with sour cream and chives and a black pepper tortilla chip topped with crispy fried smoked pork belly, zesty blueberry peach salsa, chipotle crema and cilantro

** Smoked baby back ribs with homemade pork and molasses baked beans

**Pumpkin Swirl Cheesecake with candied pumpkin seeds and cinnamon cream

** “ Bangers and Mash” Candied Bratwurst Sausage, Cranberry & Red Onion Chutney and Chive Mash

** Baked “Pumpkin & Apple Smoothie” with kisses of cinnamon

Served along side “Smoked Turkey on a Grilled Bun, topped with homemade stuffing & cranberry sauce

** Fire Roasted Beet Soup with Nova Scotia honey and fresh thyme

** “Apple Charlotte” served on a vanilla custard

** Berry Ice Tea & “Heart of Darkness” Dark Roast Coffee

** Shortbread/Fruit Cake

** Striploin Pot Pie with “North Shore” Lager

and more.......

Live music with "Julie Johnstone & Friends", cash bar with many local favorites, friends and all this delicious food ! Call Fran @ 895-6328 to book your seat.![]()