Businesses across Canada are voicing well-founded concerns about the federal government’s proposed tax changes for privately-held corporations. The proposed legislation is one of the most significant changes to tax regulation in 50 years and the government has provided a mere 75 days (during summer) to provide feedback. The business community needs more time to assess these complex changes to fully understand the wide-spread impact this will have on small- to medium-sized businesses. We need Minister Morneau to extend the deadline beyond October 2nd, 2017 to allow for proper consultation.

If implemented, these changes will drastically degrade the financial stability of all small businesses and not just a group of ‘highly paid individuals who are reluctant to pay their fair share of taxes.’ It will impact all incorporated private business, such as: start-ups, corners stores, farmers, or individuals who offer services like lawyers, accountants and other consultants.

In fairness, no one likes to pay more taxes, but we know the government also needs to reform the current tax legislation to address situations where individuals do not pay their fair share. However, the proposed tax changes on income splitting, holding passive income in a private corporation, and converting regular income into capital gains will apply to all privately-held corporations and not just the minority of high-income individuals.

Why should we care if small businesses can split income among family members, accumulate tax-advantaged savings, or maximize the sale price of their business through capital gains to fund their retirement? Because these changes may stop people from opening new businesses, or existing businesses from re-investing and expanding, or it could cause the prices of everyday products and services to go up as businesses absorb tax increases—all at a time when we need more business, more expansion, more jobs and competitive pricing in Atlantic Canada.

We need legislation to support small business in our region, not hinder it. Most incorporated private businesses are owned by friends and neighbours who are at the core of our communities. In fact, according to Statistics Canada (July 2017), 85-90 per cent of businesses across Canada are small-to-medium in size (80 per cent of which have less than 20 employees). These businesses create jobs locally and to drastically change the financial attractiveness of operating a business by adding unnecessary risk will slow economic development in Atlantic Canada.

You see, unlike an ‘employee’ who may have access to a company-sponsored health plan, retirement plan, sick leave, maternity leave, or other benefits; a small business owner must pay for these benefits. They often will put personal assets at risk to fund their business, and family members often help operate the business. Speak with anyone who has ever started a small business and they will tell you it takes several years to get it up off the ground or to even make a profit before they recoup their start-up costs.

At the heart of these tax changes, is a proposal to impose ‘reasonableness tests’ that will dictate how much a family member who assists with business operations can be paid (known as income splitting). This provision is very vague and open to interpretation. We believe more understanding and rigor to reduce ambiguity is a ‘reasonable expectation’ for business planning and stability.

Small businesses must plan and provide for financial outlays, so it is similarly unfair to significantly increase the taxes applied to savings held within a corporation (known as passive investment) across the board. These savings are retained for a variety of reasons like paying benefits or salaries to employees during periods when business slows or is not profitable, or for future business investments—and these retained earnings are eventually taxed as personal income if the funds are withdrawn from the company.

Lastly, people should have a reasonable expectation they can sell their business and provide for their retirement (like an employee can do). In 2017, a shareholder (who may be a family member or someone who holds shares through a family trust) of a qualified business is exempt from taxation up to just over $835,000 from the sale of the shares of the business. The government is now proposing new restrictions for claiming this exemption. Also, they are proposing that if a shareholder sells shares of the family business after July 18, 2017 to a family member’s corporation, the gain may be taxed as a dividend rather than as a capital gain. Further, if the shares were originally acquired from another family member, there could be double taxation—this could adversely impact the transfer of businesses from one generation to the next.

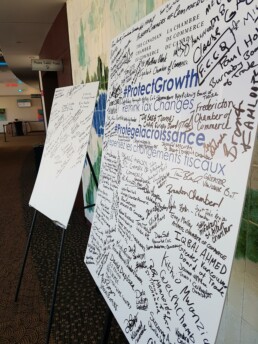

Atlantic Canadians can not risk additional economic uncertainty such wide-sweeping tax changes could create. The consequences could mean business creation is stalled, business owners will increase prices, or jobs are reduced or not created. We need economic policy and taxation solutions to work for Atlantic Canadians, that support business and create jobs, and we need to be properly consulted on any tax changes. Visit the Atlantic Chamber of Commerce’s website (extendthetaxdeadline.ca) to learn more, share your business impact story, and to send a letter to your MP with a clear message for the Finance Minister to extend the consultation deadline on the Taxation of Private Corporations beyond October 2nd, 2017.

Sheri Somerville

CEO

Atlantic Chamber of Commerce